How a National Post column attacking environmental activist misses the mark.

This opinion piece was first published by The Tyee and is republished here with permission from the author and publisher.

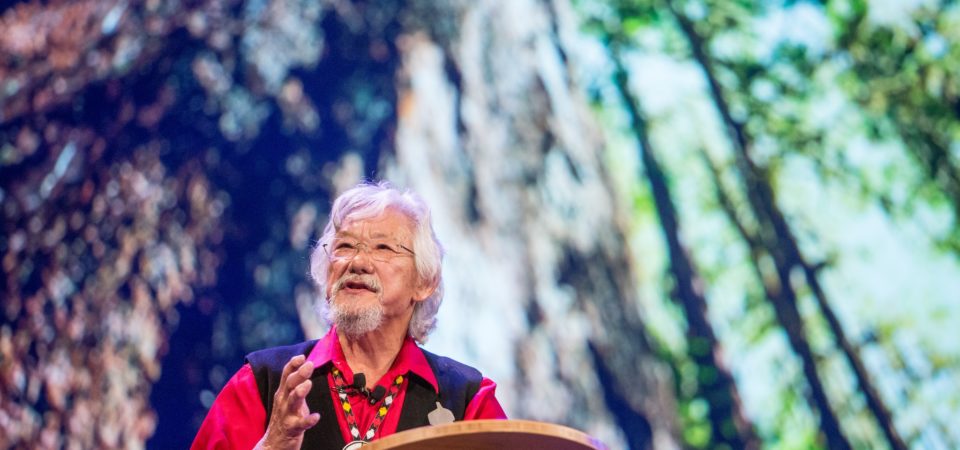

In a recent article in the National Post, University of Alberta economist Andrew Leach roundly criticizes geneticist and eco-activist David Suzuki — about to be awarded an honorary degree by Leach’s university — because of the latter’s alleged ignorance of mainstream economics.

It probably doesn’t help that Suzuki opposes tar sands development. Suzuki apparently thinks that economists would have us ignore the environmental damage caused by such economic activity. Economists take particular offence at Suzuki’s seemingly outrageous claims (in the 2011 documentary Surviving Progress) that economics is “a form of brain damage” and a “pretend” science.

One can discount exaggeration in disputes between disciplines, but are there grounds for thinking Suzuki is more than a little bit right about neoliberal economics?

To illustrate Suzuki’s supposed ignorance, Leach points out that there is “an entire discipline of economics dealing with valuing environmental damage” — so-called “externalities” — so that appropriate taxes can be used to “internalize” the damage.

The theory is simple, particularly if we ignore the ethical dilemma associated with commodifying nature (we really shouldn’t). Economists apply the term “externalities” to real costs of production that are not reflected in consumer prices — those outside the market. The missing costs are a form of market failure, since underpricing leads to inefficient over-consumption of the goods in question.

However, governments can correct for that failure, for example by adding a pollution tax to the market price, thus “internalizing” the cost. Since consumers will now pay a higher price closer to the actual cost of production, consumption decreases. True-cost pricing restores efficient market equilibrium.

Well, the theory sounds good. But do economists really believe that “externalities” are merely their way of identifying damage costs not presently reflected in prices so that taxation or pollution charges can “internalize” them?

If so, shouldn’t they be in a collective rage over the general failure of governments to correct for at least the known ecological damages associated with climate change, land/soil degradation, deforestation, biodiversity loss, deforestation, mining, oil and gas development, pesticide use and other damaging externalities? The world is in overshoot, reeling from a frontal assault by externalities, but neoliberal economists seem all but absent from the battle.

This should be a little embarrassing.

Conventional economists may have a reason for their reticence. It is quite possible, as some ecological economists believe, that in present circumstance, an accurate account of the market plus external costs of an additional increment of GDP growth would exceed the associated benefits.

If so, growth is uneconomic, making the world poorer rather than richer. Logical consistency would demand economists (and governments) give up their universally treasured myth of perpetual growth and focus instead on redistribution.

There is still more to the externalities story — consider the following convoluted sub-plot. Economists have spawned the novel concept of “under-polluted environments,” which, in effect, rationalizes the deliberate creation of potential externalities in the interest of growth.

The theoretical argument begins with economists’ belief that relatively pristine environments represent an unused resource and economic opportunity because, up to a point, ecosystems can assimilate local pollution at no monetary cost (or at least at a lower cost than the value of resultant GDP growth). This means that pollution controls that might be legitimate in some countries could be economically damaging in others that have apparent surplus assimilation capacity. By imposing “unwarranted” production costs on goods from developing countries, for example, pollution charges would hinder exports and hence lower GDP growth.

Moreover, because nations value their environments differently, “…we might expect developed nations to export pollution-intensive industries (dirty industries) to… developing nations where the opportunity cost of that pollution is lower and the need for income is greater,” economists have argued. (Lawrence Summers, then chief economist at the World Bank, put this a little more crudely in 1991 when he wrote “a given amount of health impairing pollution should be done in the country with the lowest cost, which will be the country with the lowest wages. I think the economic logic behind dumping a load of toxic waste in the lowest wage country is impeccable.”)

For all these reasons, World Trade Organization rules discourage discrimination against products from developing countries that choose to subsidize production by polluting their air and water.

Now doesn’t all this sound just a little like granting licence for corporations and governments to “ignore environmental damage?” Can we award the point to Suzuki?

There is actually a much bigger issue at stake here. The entire externalities thesis assumes that we can accurately identify, quantify and price all significant present and future non-market costs, and that local eco-damage can be viewed in isolation of cumulative global trends. Neither assumption is remotely correct, particularly in a world in overshoot. A conceptually elegant economic concept thus fails utterly in practice.

And we can extend this reasoning more broadly. As implied above, much of neoliberal economics is rationalized on “efficiency” grounds: not only should economic activities produce greater benefits than costs (including externalities), but society should also strive to maximize the difference.

This is the essence of benefit/cost analysis. However, as already noted, satisfying these key criteria assumes that all important non-market benefits and costs can be accurately priced. Unfortunately, because of complex systems dynamics (hidden systemic relationships, lags in cause-effect responses, unknown threshold effects, etc.), it is not even theoretically possible to identify, let alone quantify and monetize, many potential ecological impacts before they occur. The collapse of raptor populations decades after the broadcast use of pesticides, the increase in environmental cancers and the 20 to 40 year lag between GHG emissions and climate effects come immediately to mind — as does the possible future collapse of civilization because of today’s uncompromising economic expansionist agenda. (The latter would be very costly!)

Bottom line — the inability to identify and monetize important biophysical and, for that matter, social costs of overshoot invalidates the efficiency criterion, discredits social discounting (how can we discount future costs we cannot even know?) and reveals formal benefit/cost analyses of large projects to be a hazardous (and sometimes deliberately deceitful) shell game.

In fact, the collapse of efficiency undermines the theoretical basis and practical value of neoliberal economic analysis in any complex situation.

This opinion piece was first published by The Tyee and is republished here with permission from the author and publisher.

William E. Rees is professor emeritus of human ecology and ecological economics at the University of British Columbia.

The MAHB Blog is a venture of the Millennium Alliance for Humanity and the Biosphere. Questions should be directed to joan@mahbonline.org

MAHB Blog: https://mahb.stanford.edu/blog/neoliberal-economics-pretend-science/

The views and opinions expressed through the MAHB Website are those of the contributing authors and do not necessarily reflect an official position of the MAHB. The MAHB aims to share a range of perspectives and welcomes the discussions that they prompt.