Welcome to Part I of the Silver Gun Hypothesis. The main introduction to this essay is found here.

The topics covered in Part I include (i) an introduction to the Silver Gun Hypothesis and how the hypothesis relates to symmetric carbon pricing — called ‘carrot-and-stick’ carbon pricing, and (ii) an introduction to carbon as the primary building block of living systems and a primary influencer of climate change.

Part I is a gentle reminder — especially for economists — that carbon plays a central role in structuring natural living systems and the climate. Carbon’s role in nature is not groundbreaking news for most scientists, but we need to remind ourselves that carbon is ‘special’. We will refer to these fundamental ideas in the next four parts of this essay:

Part II – The Entropy of Carbon

Part III – Risk and Entropy

Part IV – Money as Environmental Policy

Part V – Holistic Framework for Economic Sustainability

Global Carbon Reward

It is important to appreciate that carbon has extraordinary functionality. Carbon is a major structural component of life, and can store and release abundant amounts of chemical energy. The vitality of carbon is relevant to the economy because civilization behaves like a super-organism that feeds on plants, animals, biofuels, coal, oil, and natural gas.

In this essay we will consider the possibility that economics textbooks are missing a critically important policy for climate mitigation. The Silver Gun Hypothesis is a claim that a Global Carbon Reward is needed to manage the systemic risks of climate change [7][8]. A reason that stakeholders do not discuss a Global Carbon Reward is that most policy makers employ neoclassical models that focus on market efficiency and fiscal budgets [2]. The Global Carbon Reward is different because it focuses on risk management and currency supply [8][31].

Chen, van der Beek and Cloud developed the Global Carbon Reward as a ‘systems solution’ for climate change [7][8]. The policy is metaphorically described as the ‘Silver Gun’ because it is designed to finance the widest possible spectrum of climate mitigation actions in all sectors of the world economy. The reward is self-funding through currency trading (i.e. monetary policy) and the approach should empower market actors to implement socially responsible technologies that can slow or reverse climate change. The Global Carbon Reward creates a new context for economic value: the price that the world is willing to pay to protect the planetary ecosystem and civilization by mitigating climate change and providing co-benefits [7][8].

Figure I-1. Carbon is King | Wikipedia & Ian Lindsay

What is the Big Deal?

The Silver Gun Hypothesis challenges the standard economic worldview by looking at climate policies from a new perspective. The insight of the Silver Gun Hypothesis is the idea that ‘carrot-and-stick carbon pricing’ is needed to address the market failure, because (a) carbon taxes are needed to improve market efficiency, and (b) carbon rewards are needed to manage systemic risk, respectively. In recent years, there is growing awareness that the ‘sticks’—such as carbon taxes and cap-and-trade—are insufficient [12][44][45]; and that global warming of more than 2°C may result in a tipping point being passed [13][19][22][25].

The idea of carrot-and-stick incentives for pricing carbon is missing in the literature. Subsidies and carbon-offset credits might be interpreted as ‘carrots’, but the Silver Gun Hypothesis defines the ideal carrot as the Global Carbon Reward. This new policy involves an international unit of account denominated in carbon mitigated (100 kg CO2 equivalent mitigated) and reward prices that are coordinated with central bank monetary policy [5][7][8][31]. A currency and supporting monetary policy are recommended as the essential components of a sustainable carbon economy because they can help resolve temporal paradoxes, such as unsustainable economic growth [8], Jevons paradox [16], and the time discounting of climate damages [5][8]. A technical discussion of these topics is available in the reference list [5][6][7][8][31].

The Silver Gun Hypothesis — which is technically called the Holistic Market Hypothesis [8] — focuses our attention on the idea that complex living systems require relationship symmetry to metabolize carbon for homeostasis. Although climate policies are not living systems, it is posited that these policies interact with civilization via thermodynamic relationships that have a meta-system structure that can be compared with natural living systems. This topic is covered in Parts II, III and IV.

Carrots-and-Sticks

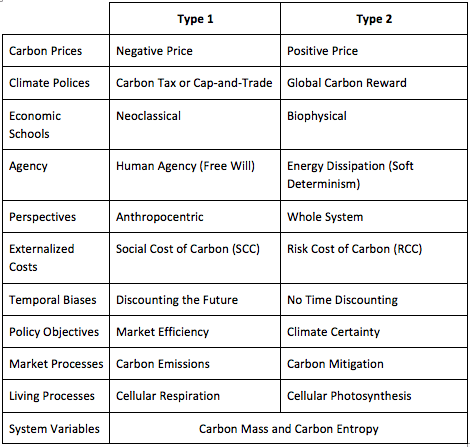

‘Sticks’ are recommended by policy makers to limit carbon emissions. Common policies include regulations, taxes and cap-and-trade. ‘Carrots’ are proposed here for carbon mitigation. What is important about complementary pricing — carrot-and-stick carbon pricing — is that it can be understood through the laws of thermodynamics and a concept of ‘price symmetry’. An interesting feature of the Silver Gun Hypothesis is that the (Type 1) carbon tax is recognized as the ideal policy for managing costs and market efficiency, whereas the (Type 2) carbon reward is recommended as the ideal policy for managing systemic risk and climate certainty. The gist of the Silver Gun Hypothesis is that ‘carrot-and-stick’ incentives naturally associate with these objectives as a biophysical reality. The objective of this essay is to explain the hypothesis in a relatively simple way. The implications of the hypothesis — if correct — are major for public policy and sustainability theory.

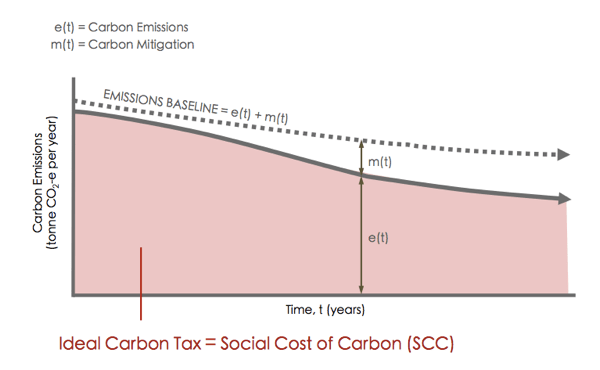

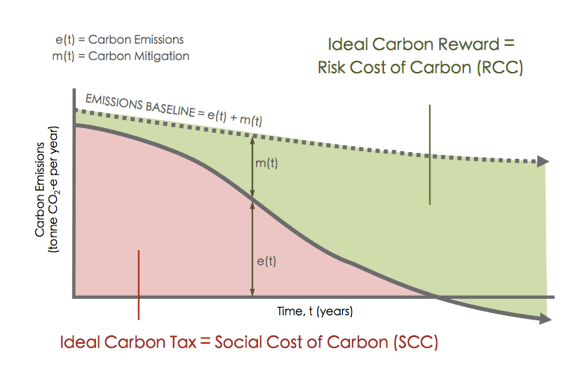

If we are to consider the Silver Gun Hypothesis, we will also need to consider the possibility that climate policies will reflect the laws of nature because they influence energy dissipation, the mass of carbon in the atmosphere (units of kg), and the entropy of carbon in the environment (units of J/K). To begin, let’s first consider that the standard model only defines one type of externalized cost: the Social Cost of Carbon (SCC), which is a negative externality (see Equation I-1 and Figure I-2). The Silver Gun Hypothesis completes the symmetry in externalities by introducing the Risk Cost of Carbon (RCC), which is a positive externality (see Equation I-2 and Figure I-3).

The SCC is the time-discounted climate-related damages that are experienced economically. The RCC is fundamentally different to the SCC, because the RCC is the cost of limiting the systemic risk of unwanted climate change. The RCC is the cost of insurance that global warming will be mitigated to a level that meets a chosen risk tolerance (e.g. less than 33% chance of exceeding 2°C of warming). The cost of managing risk is not a new concept, and the insurance industry and actuaries are familiar with the cost of managing risk [32]. We may call this risk management approach a type of ‘preventative insurance’.

The Silver Gun Hypothesis makes a clear distinction between risk and damage as two different types of cost. The risk that we are interested in relates to the probability of unwanted climate change, and not to financial risk that markets may experience.

The symmetry of Equation I-2 implies that the RCC can be internalized into the world economy with a Global Carbon Reward for mitigation: the carrot. This is illustrated in Figure I-3 for a market actor with an assessed emissions baseline. The approach can be applied to any technology or market sector by applying rules and standards for defining the relevant emissions baselines, and keeping in mind that these emissions baselines are probabilistic.

Symmetry in Pricing

Important is that the policy for a carbon reward is derived from the policy for a carbon tax using an epistemology of symmetry and the ‘laws of nature’ [8]. These laws include the First Law for energy conservation (which is time symmetric), and the Second Law for increasing entropy (which is time asymmetric). These two laws constrain the mass of carbon entering the atmosphere, and the changing entropy of carbon in the environment. Both variables — mass and entropy — are addressed in the development of this new model for a sustainable carbon economy [8].

The key reason that the entropy of carbon is important is that it brings the ‘arrow of time’ into policy analysis. The concept of entropy is used to solve the temporal paradoxes that are inherent to the standard economic model. The three most prominent temporal paradoxes are (i) the paradox of unsustainable economic growth [27], (ii) Jevons paradox [16], and (iii) the paradoxes of time discounting [3][4][11][18][21][26][30]. Entropy is outside in the scope of neoclassical economics, and so we need to look towards biophysical economics to understand Equation I-2.

Externalized Cost of Carbon = Social Cost of Carbon (SCC)

Equation I-1. The standard model for the negative externalized cost of carbon.

Externalized Costs of Carbon = Social Cost of Carbon (SCC) + Risk Cost of Carbon (RCC)

Equation I-2. The expanded model for negative and positive externalized costs of carbon.

Figure I-2. The standard model for pricing carbon is focused on taxing carbon emissions. The ideal carbon tax is equivalent to the Social Cost of Carbon (SCC). The pink shaded area denotes the total carbon tax collected over time.

Figure I-3. The expanded model for pricing carbon involves a tax on carbon emissions and a reward for carbon mitigation, but as separate policies. The ideal global carbon reward is equivalent to the Risk Cost of Carbon (RCC). The green shaded area denotes the total carbon reward issued over time.

Economic growth is currently a paradox because politicians and central banks promote economic growth when this growth is likely to be unsustainable in terms of carbon emissions [14][27]. Economic growth drives greater demand for primary energy, including fossil fuels, which undermines efforts to stabilize the climate [14][22][27]. The analytical model developed by Chen, Cloud and van der Beek [8] proposes that a Global Carbon Reward could be used to manage economic growth by internalizing the RCC. It appears that the internalization of the RCC might resolve not just one, but possibly all of the temporal paradoxes that have troubled economists and philosophers for decades [5][8]. This is evidence that the Silver Gun Hypothesis is likely to be valid and is worth investigating (refer Parts II and III).

The Silver Gun Hypothesis will likely be met with resistance, not only because it requires validation, but also because it challenges the anthropocentric perspective that dominates mainstream economics. The classical worldview is by definition anthropocentric. This is because economists typically assume that the objective of economics is to allocate scarce resources in ways that are maximally efficient for human consumption. This worldview is closely associated with the Paradox of Agency, as described in the Introduction (see Box 1). The Paradox of Agency is identified here to be the root cause of the temporal paradoxes in climate change economics. These temporal paradoxes are discussed in the economics literature, and here I propose that these paradoxes are resolvable with symmetric carbon pricing — carrots-and-sticks — and the concept of entropy.

Carbon’s Biophysical Properties

To refresh our scientific knowledge, let’s focus on the following question: why is carbon the ‘King’ of the elements? We will consider this question by reviewing carbon’s atomic structure and some important examples provided by nature. In the next section we will look at the metabolic symmetry of carbon and the idea of ‘degrees of freedom’ in physical systems and climate policies.

(a) Atomic Structure

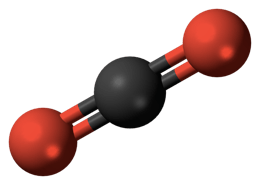

Carbon is the King because it is the most functional building unit in the periodic table of elements. The functionality of carbon is the result of its atomic structure. Carbon has a relatively small nucleus of six protons and six neutrons. It also has six electrons, with two in its complete inner ‘electron shell’, and four in its incomplete outer ‘electron shell’. The outer shell has a capacity to accept four more electrons in covalent bonds, and this gives carbon its structural potency. Carbon (C) can bond with itself and various other elements, including hydrogen (H), oxygen (O), nitrogen (N), calcium (Ca), and phosphorus (P).

Figure I-4. Carbon dioxide (CO2) with its double-covalent bonds

Attribution for Image: Wikipedia

(b) Living Organisms

Carbon produces a wide diversity of molecules and biomolecules with linear, planar and three-dimensional geometries. The most common elements in organisms are hydrogen (H), oxygen (O), and carbon (C), followed by nitrogen (N), phosphorus (P) and sulfur (S). Evidence that carbon is the ‘King’ of the elements is provided by the fact that all life is carbon-based. For example, the two most common ingredients in the human body are liquid water (H2O) at 57-60% by mass [46], and carbon at 18.5% by mass [46].

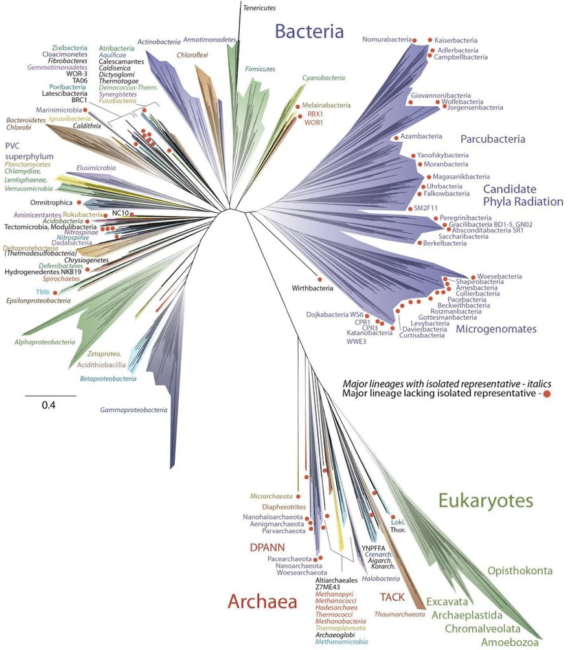

The biological ‘Tree of Life’ summarises the evolution of known species (see Figure I-5). Scientists can compare the carbon content of organisms in relation to their C:N:P ratios, called ‘C:N:P stoichiometry’. According to Vrede et al. [29], these C:N:P ratios can “…mechanistically connect growth strategy and biochemical and cellular mechanisms of biota to major ecological consequences”. [29]

(c) Information Storage

Carbon is central to the process of evolution because it is a major structural component of DNA. DNA provides the long-term storage and reproduction of biochemical information: the blueprint of species.

The amount of information contained in DNA is vast. Researchers have found that it is possible to encode man-made digital data into DNA. A new technology, called DNA Fountain, can store data in DNA at extreme densities [33]. DNA data centers may one day deliver a new era in information technology:

“the system could, in principle, store every bit of datum ever recorded by humans in a container about the size and weight of a couple of pickup trucks.” [33]

Figure I-5. The Tree of Life shows the evolutionary links for Earth’s known species [15].

Figure I-6. In 1953, Watson and Crick discovered that DNA has a double helix structure comprising two long molecules twisted around each other like a ladder. The steps in the ladder are comprised of (A) adenine, (C) cytosine, (G) guanine, and (T) thymine; and the ordering of A, C, G and T is the genetic coding of DNA [34].

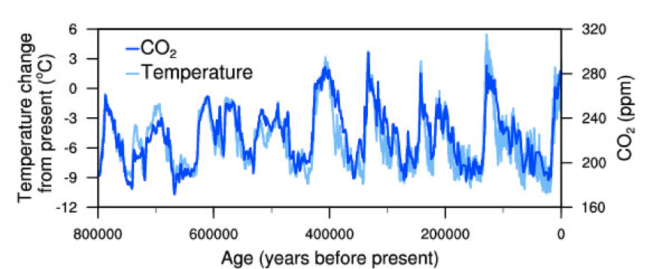

Figure I-7. Glacial cycles are strongly correlated to the atmospheric carbon dioxide (CO2) concentration [37].

(d) Chemical Energy

Relevant to the biological sciences is the amount of chemical energy stored and release by biomolecules. For example, proteins, sugars, wood, and fossil fuels have an energy content of between 5-55 MJ per kg [35]. Important to the functioning of living cells and organisms is a biomolecule called adenosine triphosphate or ATP (C10H16N5O13P3). ATP has been called the ‘molecular unit of currency’ because it behaves like a chemical battery and delivers energy within organisms. For example, the human body requires that ATP be recycled at the rate of 500-750 times per day, which equates to 50-75 kg of ATP usage per day [36].

(e) Greenhouse Effect

Carbon is a major factor in the Earth’s greenhouse effect. The greenhouse potency of carbon dioxide (CO2) and methane (CH4) is related to the frequency of radiation that these molecules absorb and emit through vibration. There is remarkable correspondence between atmospheric concentrations of CO2 and the temperature of the Earth’s surface over geological time (see Figure I-7). Glacial cycles during the past several hundred thousand years show a strong feedback between CO2 and temperature (Figure I-7). The glacial swings are also affected by natural cycles and changes in vegetation cover and ice extent [37]. A key point is that ecosystems have co-evolved with atmospheric CO2 and climate change over billions of years.

(f) New Technologies

A final point is that crystalline carbon structures have remarkable properties. For example, graphene — a single layer of carbon arranged in a hexagonal lattice — is a semi-metal, conducts heat and electricity efficiently, and is the strongest material in terms of tensile strength (130.5 GPa). Scientists have used graphene to build batteries with greater capacity and faster charging speeds than standard lithium-ion batteries. For example, Samsung developed a graphene battery that can fully recharge in 12 minutes for use in smartphones and electric vehicles [38].

Another example is the carbon nanotube transistor. The Franklin’s group has demonstrated that carbon nanotube transistors, smaller than 10 nanometers, are faster and more energy efficient than transistors made of silicon. Theoretical work suggests that a carbon nanotube computer could be an order-of-magnitude more energy efficient than the best silicon computers [40].

Symmetry in Complex Living Systems

We should appreciate that carbon is fundamentally important for living organisms, ecosystems, and civilization because it provides: (a & b) structure, (c) information storage, (d) energy storage and energy transfer, (e) the greenhouse effect, and (f) useful technologies.

Physical systems have a property called degrees of freedom, whereby the number of the degrees of freedom determines the number of controllers required to achieve a specific system objective. How many degrees of freedom should we expect in the management of carbon when using carbon pricing? According to neoclassical economists, the answer is ‘one’. This is because neoclassical economists only consider the carbon tax to be important for internalizing the SCC (refer Equation I-1). But is this reasonable?

When we examine the Earth’s natural carbon cycle, we can see that complex living systems release CO2 by cellular respiration, and absorb CO2 by cellular photosynthesis. These are the main processes that govern the total biomass in the environment and the associated carbon. These two processes are summarized as follows [41]:

6 CO2 + 6 H2O + light energy = C6H12O6 + 6 O2

Equation I-3. Basic formula for cellular photosynthesis

C6H12O6 + 6 O2 = 6 CO2 + 6 H2O + chemical energy

Equation I-4. Basic formula for cellular respiration

The first microbes to produce oxygen (O2) by photosynthesis emerged more than 2.3 billion years ago. Important was the arrival of oceanic cyanobacteria, which contributed to the Great Oxygenation Event (GOE) about 2 billion years ago [42]. After eons of time had passed, plant photosynthesis emerged as a major factor in the Earth’s evolving climate. The appearance of non-vascular land plants, including liverworts and mosses, about 470 million years ago resulted in the sequestering of large amounts of atmospheric CO2 and an ice age that caused a mass extinction [20]. The following evolution of vascular land plants during the Devonian period, about 419.5 million years ago, produced tall forests, new habitat, and again resulted in the sequestering of large amounts of atmospheric CO2 [43].

If plants and other organisms buffer the concentration of carbon in the atmosphere with (Type 1) respiration and (Type 2) photosynthesis, then what does this say about the degrees of freedom for complex living systems? Here it is claimed that there are ‘two’ degrees of freedom for carbon in living systems because of the opposing processes: respiration and photosynthesis.

Could the evolution of land plants be an analogue for what is needed to restructure the economy? When we consider civilization, we are confronted by two market processes: (Type 1) carbon emissions through combustion of fuels and biomass, and (Type 2) carbon sequestration through specific activities, such as reforestation, Carbon-Capture and Storage (CCS), Carbon Dioxide Removal (CDR), etc. These two processes are similar to (Type 1) respiration and (Type 2) photosynthesis, in that they are opposing and complementary processes. It is posited here that these two market processes have symmetry and represent two degrees of freedom. In later parts of this essay we will present a meta-system framework that describes (Type 1) respiration and (Type 2) photosynthesis in relation to carbon pricing (see Parts II and III).

Symmetry in Climate Policies

Let’s consider the objectives of mitigating climate change according to the 2015 Paris Climate Agreement: “…limiting the risks and impacts of climate change” [28]. The Paris Climate Agreement confirms that there are two major objectives related to the (Type 1) ‘impacts’ and the (Type 2) ‘risks’. We may directly compare (Type 1) ‘impacts’ with the SCC, and (Type 2) ‘risks’ with the RCC (refer Equation I-2 and Figure I-3).

What about Entropy?

The mainstream narrative on climate change and the carbon budget refers to the mass of carbon that enters the atmosphere—but what about the entropy of carbon? If we can accept the idea that both the mass and entropy are system variables for carbon, then these two variables support the claim that there are two degrees of freedom for pricing carbon. If we accept that there are two degrees of freedom, then we will need an expanded framework for carbon pricing.

The various types of symmetry that are mentioned in Part I of this essay are listed in Table I-1. An important claim is that (Type 1) negative carbon pricing is anthropocentric, including the notion of time discounting, which is a product of human psychology. On the other hand, (Type 2) positive pricing is related to system behaviors, such as the behavior of the Earth’s climate system, and the concept of systemic risk, which is the uncertainty of future unwanted events. In Parts II and III of this essay we will discuss the expanded symmetric model for externalized costs (refer Equation I-2).

Table I-1. Symmetry in carbon pricing and natural living processes.

Concluding Remarks

The discussion presented in Part I supports the first major concept introduced in the introduction to the Silver Gun Hypothesis:

(Concept I) Carbon is the molecular building block of living systems and is a primary factor in climate change. For this and other reasons, the world economy should be restructured with a unit of account denominated in carbon mitigation services.

A handful of social scientists have looked carefully at the way human cooperation is influenced by carrot-and-stick incentives [1] [9]. They found by experiment, that carrot-and-stick incentives have a profound positive influence on social cooperation compared with just ‘sticks’ or just ‘carrots’. These results indicate that carrot-and-stick carbon pricing is likely to be an effective policy option for mitigating climate change. But why do economists and policy makers ignore ‘carrots’ when addressing climate change? The answer provided here is that the ideal policy for carrots cannot be understood within a neoclassical economic framework, and so a formal theory for ‘carrots’ has been overlooked.

The gist of the Silver Gun Hypothesis is this: even though regulations, taxes and cap-and-trade may be effective at managing other pollutants, such as acid rain, these standard policies are insufficient for managing carbon because carbon is too strongly coupled to energy. It is claimed that symmetric carbon pricing — negative and positive carbon pricing — are needed to control civilization’s carbon balance. In Parts II and III we will examine a biophysical economic model that underpins the Silver Gun Hypothesis. A model that links carbon taxes to the SCC, and links carbon rewards to the RCC (refer Figure I-2).

I hope you will join me in Part II of the Silver Gun Hypothesis, when I will begin applying the laws of nature to symmetric carbon pricing.

Footnote: The Politics of Carbon

Nathaniel Rich recently published an article in the New York Times (NYT) describing the politics of climate change between 1979-1989 [23]. Jake Silverstein, the NYT editor, added:

“It will come as a revelation to many readers — an agonizing revelation — to understand how thoroughly they grasped the problem and how close they came to solving it.” [23]

But is this true? Did the major players really know how to solve the climate crisis? Naomi Klein laments that consumer capitalism and free-markets are preventing appropriate action on climate change. She makes her views clear on this issue:

“We are stuck because the actions that would give us the best chance of averting catastrophe — and would benefit the vast majority — are extremely threatening to an elite minority that has a stranglehold over our economy, our political process, and most of our major media outlets.” [17]

Why do standard climate policies — including regulations, carbon taxes and cap-and-trade — fail to reform the economy and resolve the climate crisis? Is the political problem the result of a behavioral or cognitive defect of the human species, or is the root cause something else?

The Silver Gun Hypothesis challenges the notion that we are stuck in a hopeless political situation, and it also challenges the notion that scientists and economists have known how to resolve the climate crisis since the 1980’s. The alternative is that the neoclassical model for externalized costs should be expanded to reflect the laws of nature. If we do not come to understand economics within this context, then why should we — as an intelligent species — expect to gain control of our own carbon balance?

Figure I-8. Should we change the politics (left), or should we change the economics (right)?

References

[1] Andreoni, J., Harbaugh, W., and Vesterlund, L. (2003). The Carrot or the Stick: Rewards, Punishments, and Cooperation. American Economic Review, 93 (3): 893-902.

[2] Boyce, J. K. (2018) Carbon Pricing: Effectiveness and Equity. PERI, Political Economy Research Group, Univ. of Massachusetts Amherst. April 2018 Working Paper Series Number 457.

[3] Carney, M. (2015). Breaking the Tragedy of the Horizon – climate change and financial stability. Speech given by the Governor of the Bank of England, Chairman of the Financial Stability Board, Lloyd’s of London 29 September 2015

[4] Carney, M. (2016). Resolving the climate paradox. Speech given by the Governor of the Bank of England, Chair of the Financial Stability Board, Arthur Burns Memorial Lecture, Berlin 22 September 2016.

[5] Chen, D. B. (2018). Chapter 15 – Central Banks and Blockchains: The Case for Managing Climate Risk with a Positive Carbon Price. In A. Marke (Ed.), Transforming Climate Finance and Green Investment with Blockchains (pp. 201–216). Academic Press.

[6] Chen, D. B. (2018). Utility of the Blockchain for Climate Mitigation. The Journal of British Blockchain Association, 1 (1): 1-9.

[7] Chen, D.B., van der Beek, J. and Cloud, J. (2017). Climate mitigation policy as a system solution: addressing the risk cost of carbon. Journal of Sustainable Finance & Investment, 7 (3): 1-42.

[8] Chen, D.B., van der Beek, J. and Cloud, J. (2018). Hypothesis for a Risk Cost of Carbon: Revising the Externalities and Ethics of Climate Change. In: Understanding risks and uncertainties in energy and climate policy: Multidisciplinary methods and tools towards a low carbon society. Springer Open Access Book. Ed: TRANSrisk (in press).

[9] Chen, X., Sasaki, T., Brännström, Å., and Dieckmann, U. (2015). First carrot, then stick: how the adaptive hybridization of incentives promotes cooperation. Journal Royal Society Interface, 12: 20140935.

[10] CPLC (2017). Report of the High-Level Commission on Carbon Prices. Carbon Pricing Leadership Coalition, May 29, 2017 (62 pp.). [Accessed 21 May 2018]

[11] Dietz, S., Gollier, C., and Kessler, L. (2018). The climate beta. Journal of Environmental Economics and Management, 87: 258-274.

[12] Donnelly, A. (2018). #31 Aldyen Donnelly on Why Carbon Pricing Hasn’t Worked So Far. NORI Podcast, July 17, 2018.

https://nori.com/podcast/31-aldyen-donnelly-on-why-carbon-pricing-hasnt-worked-so-far

[13] Fischer, H., Meissner, K.J., Mix, A.C., et al. (2018). Palaeoclimate constraints on the impact of 2 °C anthropogenic warming and beyond. Nature Geoscience, 11: 474-485.

[14] Garrett, T. J. (2012). No way out? The double-bind in seeking global prosperity alongside mitigated climate change. Earth System Dynamics, 3, 1-17.

[15] Hug, L.A., Baker, B.J., Anantharaman, K., Brown, C.T., Probst, A.J., Castelle, C. J., Butterfield, C.N., Hernsdorf, A.W., Amano, Y., Ise, K., Suzuki, Y., Dudek, N., Relman, D.A., Finstad, K.M., Amundson, R., Thomas, B.C., Banfield, J.F. (2016). A new view of the tree of life. Nature Microbiology. 1: 16048.

[16] Jevons, W. S. (1866). The Coal Question; An Inquiry concerning the Progress of the Nation, and the Probable Exhaustion of our Coal-mines. London: Macmillan and Co., 1866. 2nd edition, revised.

[17] Klein, N. (2014). This Changes Everything: Capitalism Vs. The Climate. Simon and Schuster, 16 Sep. 2014. (566 pp.)

[18] Kousky, C., Kopp, R.E., and Cooke, R. (2011). Risk Premia and the Social Cost of Carbon: A Review. Economics: The Open-Access, Open-Assessment E-Journal, Vol. 5, 2011-21.

[19] Lenton, T.M. (2012). Arctic climate Tipping points. Ambio, 41(1), 10 22.

[20] Marshall, M. (2012). First land plants plunged Earth into ice age. Geoscience, DOI: 10.1038/ngeo1390

[21] Nordhaus, W.D. (2007a). A Review of The Stern Review on the Economics of Climate Change. Journal of Economic Literature 45(3): 686-702.

[22] Raftery, A.E., Zimmer, A., Frierson, D.M., Startz, R., and Liu, P. (2017). Less than 2°C warming by 2100 unlikely. Nature Climate Change.

[23] Rich , N. (2018). Losing Earth: The Decade We Almost Stopped Climate Change. New York Times. Aug. 1, 2018.

https://www.nytimes.com/interactive/2018/08/01/magazine/climate-change-losing-earth.html

[24] Service, R.F. (2017). DNA could store all of the world’s data in one room. American Association for the Advancement of Science (AAAS), Mar. 2, 2017.

http://www.sciencemag.org/news/2017/03/dna-could-store-all-worlds-data-one-room

[25] Steffen, W., Rockström, J., Richardson, K., Lenton, T., Folke, C., Liverman, D., Summerhayes, C., Barnosky, A., Cornell, S., Crucifix, M., Donges, J., Fetzer, I., Lade, S., Scheffer, M., Winkelmann, R. and Schellnhuber, H. (2018). Trajectories of the Earth System in the Anthropocene. Proceedings of the National Academy of Sciences (PNAS) USA, 115(33), 8252-8259 (2018). DOI: 10.1073/pnas.1810141115.

[26] Stern, N. (2007). The Economics of Climate Change: The Stern Review. Cambridge University Press.

[27] SDC (2009). Prosperity Without Growth? – The Transition to A Sustainable Economy. (136 pp.). Professor Tim Jackson, Economics Commissioner, U.K. Sustainable Development Commission.

[28] UNFCCC (2015). Adoption of the Paris Agreement, 21st Conference of the Parties, Paris: United Nations. Report No. FCCC/CP/2015/L.9/Rev.1

[29] Vrede, T., Dobberfuhl, D.R., Kooijman, S.A.L.M. and Elser, J.J. (2004). Fundamental connections among organism C:N:P stoichiometry, macromolecular composition, and growth. Ecology, 85: 1217 – 1229.

[30] Weitzman, M.L. (2010). Risk-adjusted gamma discounting. Journal of Environmental Economics and Management 60(1): 1–13.

[31] Zappalà, G. (2018). Central Banks’ role in Responding to Climate Change: Monetary Policy and Macroprudential Regulation. Thesis. Universita’ degli studi di Padova. Dipartimento di Scienze Economiche.

[32] Zhang, Y. 2009. “A Study on Risk Cost Management.” International Journal of Business and Management 4 (5): 145.

[33] http://dnafountain.teamerlich.org/

[34] https://en.wikipedia.org/wiki/DNA

[35] https://en.wikipedia.org/wiki/Energy_density

[36] https://en.wikipedia.org/wiki/Adenosine_triphosphate

[37] https://www.ncdc.noaa.gov/global-warming/temperature-change

[38] https://news.samsung.com/global/samsung-develops-battery-material-with-5x-faster-charging-speed

[39] https://en.wikipedia.org/wiki/Graphene

[40] https://www.technologyreview.com/s/519421/the-first-carbon-nanotube-computer/

[41] https://en.wikipedia.org/wiki/Photosynthesis

[42] https://en.wikipedia.org/wiki/Great_Oxygenation_Event

[43] https://en.wikipedia.org/wiki/Devonian

[44] https://www.carbontax.org/blog/2018/07/18/agreed-carbon-pricing-isnt-working-now-what/

[45] https://www.foreignaffairs.com/articles/world/2018-06-14/why-carbon-pricing-isnt-working

[46] https://en.wikipedia.org/wiki/Composition_of_the_human_body

About the Author

Dr. Delton B. Chen is an Australian engineer who holds a Ph.D. from the University of Queensland for his hydrogeological study of Heron Island, located in the Great Barrier Reef. Delton is a modeler/analyst in groundwater, hydrology, hot-rock energy and greenhouse mitigation, and he specialises in central bank climate policy. Delton is a co-founder of the Global 4C climate policy and is the lead developer of the Holistic Market Hypothesis (HMH), which is a new hypothesis that explains how climate risk can be priced with a Central Bank Digital Currency (CBDC).

Contact: Center for Regenerative Community Solutions, 501(c)(3) Non-Profit, NJ, USA.

Web: www.global4c.org www.crcsolutions.org and www.possibleplanet.org

Email: deltonchen@crcsolutions.org

The MAHB Blog is a venture of the Millennium Alliance for Humanity and the Biosphere. Questions should be directed to joan@mahbonline.org

The views and opinions expressed through the MAHB Website are those of the contributing authors and do not necessarily reflect an official position of the MAHB. The MAHB aims to share a range of perspectives and welcomes the discussions that they prompt.

![Figure I-6. In 1953, Watson and Crick discovered that DNA has a double helix structure comprising two long molecules twisted around each other like a ladder. The steps in the ladder are comprised of (A) adenine, (C) cytosine, (G) guanine, and (T) thymine; and the ordering of A, C, G and T is the genetic coding of DNA [34].](https://mahb.stanford.edu/wp-content/uploads/2018/09/CIK_part1_image6-650x632.png)