Introduction

Many people are hoping that civilization will undergo an economic transformation for the objective of becoming ‘sustainable’ over the long run. It seems reasonable to assume that a transformational change—if it does occur—will be accompanied by a paradigm shift in economic philosophy. A paradigm shift seems reasonable in the face of the environmental and moral failings of consumerism, unregulated growth, financialization, and global capitalism (e.g. Robinson, 2014). What is needed is a more complete vision for human prosperity, whereby humanity acts as a protector of the planetary ecosystem in a new symbiotic relationship.

Our desire for sustainability is encoded into the names of two emerging schools of economic thought: ‘ecological economics’ and ‘biophysical economics’. But what precisely is the philosophy that can resolve the climate crisis and other manmade calamities? Here I offer—for your consideration—a possible solution to this difficult question. The solution is a new economic hypothesis for long run sustainability that is framed on the entropy and mass of carbon in the environment. This solution is called the Silver Gun Hypothesis.

The Silver Gun Hypothesis is a synthesis of the following four concepts that are based on existing knowledge and experience in biology, thermodynamics, governance and economics:

(Concept I) Carbon is the molecular building block of living systems and is a primary factor in climate change. For this and other reasons, the world economy should be restructured with a unit of account denominated in carbon mitigation services.

(Concept II) The entropy of the Universe is increasing, as described by the Second Law of Thermodynamics. For this and other reasons, the entropy of carbon in the environment should be factored into the assessment of climate policies and economic models.

(Concept III) Risk is “the effect of uncertainty on objectives” (ISO 2009), and risk management practices should be used to manage the world economy for long run sustainability.

(Concept IV) Money is the primary tool for standardizing value in the economy, and so new monetary systems—called service money—should be used to protect natural capital, finance socially and ecologically regenerative services, and fundamentally alter the context of value in economics.

At the heart of the Silver Gun Hypothesis is a claim that carbon taxes and cap-and-trade schemes are insufficient for managing climate risk. The Silver Gun Hypothesis is a claim that a global carbon reward can improve social cooperation, incentivize mitigation actions, and limit the risk of dangerous-to-catastrophic climate change. The global carbon reward should also be designed to incentivize ecological and social regeneration across the globe.

The global carbon reward is the financial ammunition of the metaphorical Silver Gun. The financial ammunition—the metaphorical bullets—will be offered to market actors everywhere to develop local solutions to climate change, but within a framework of globally coordinated risk management. The technical name for the Silver Gun Hypothesis is the Holistic Market Hypothesis (HMH), after Chen, van der Beek and Cloud (2017). The Silver Gun Hypothesis is more proactive than the popular meme “Think Globally, Act Locally”, because the Silver Gun is a clarion call to “Cooperate Globally, Act Locally”.

The first question that may come to mind is this: how do we finance a global carbon reward without resorting to higher taxes and tighter fiscal policies? The answer is that no direct taxes or tightening of fiscal budgets is needed, because a parallel currency can be used to fully finance the global carbon reward. This will require a new international treaty for a monetary policy that can manage a parallel currency, called ‘service money’. The hypothesis is that monetary policies and currency trading can be used to fund the Silver Gun without direct taxation. The approach is complementary to other policies, and it may resolve structural problems in the economy, including the problem of unsustainable dirty growth.

Planetary Boundaries Revisited

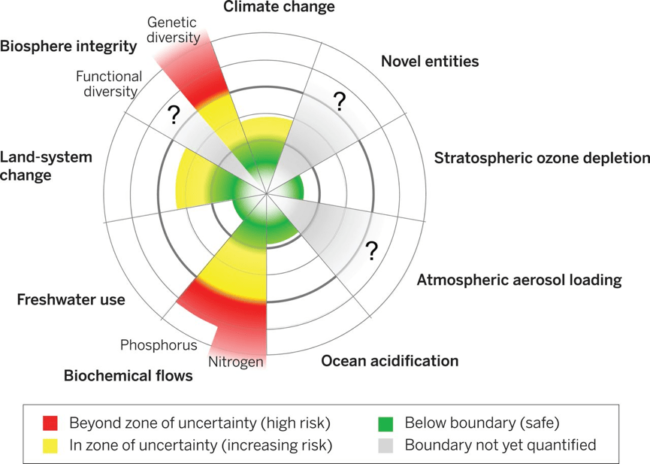

The Silver Gun Hypothesis is a calibrated response to humanity’s planetary-scale impacts on the environment. According to Rockström et al. (2009) and Steffen et al. (2015), civilization is breaching the ‘safe operating space’ of the Earth with high rates of species extinction; nitrogen (N) and phosphorus (P) pollution; climate disruption; and widespread depletion of natural capital because of land-system change. Other potential risks include ocean acidification caused primarily by CO2 emissions; widening of the ozone hole because of ozone-depleting substances; and over-use of freshwater resources (see Fig. 1).

The seven planetary boundaries of Rockström et al. (2009) are all in some way related to the climate system and carbon. At stake are irreversible tipping points in the climate system; and a systemic risk is the ‘carbon lock-in’ effect which is the path-dependency of civilization’s consumption pattern and resulting greenhouse gas (GHG) emissions. Carbon lock-in is caused by our dependency on fossil fuels and the co-evolution of infrastructure, social norms, institutions and the financial system (Unruh, 2002). A deeper understanding of the carbon lock-in effect is provided by Garrett’s (2012) biophysical analysis of the economy. Garret (2012) presents the notion that cumulative Gross World Product (GWP) is coupled to total primary energy usage, such that “…CO2 levels will likely end up exceeding 1000 ppmv, …” because of dirty economic growth.

Garrett’s (2012) interpretation is that future CO2 emissions will be dangerously high, but his interpretation is not mentioned in the mainstream media because it contradicts the optimistic narrative that underpins the Paris Climate Agreement. Garrett’s (2012) interpretation is that energy dissipation is the primary agency for CO2 emissions, but his perspective contradicts the neoclassical worldview that agency is created by human willpower. The neoclassical assumption is that the future state of the climate will be determined by political will.

The two sources of agency—(a) human willpower and (b) energy dissipation—represent the main dichotomy that separates neoclassical economics and biophysical economics. This dichotomy is a paradox because both options appear plausible. This paradox is possibly the single most important unresolved problem in 21st century economics (Box 1). Missing is a unified model that adequately describes the economy in terms of both kinds of agency.

If Garret (2012) is approximately correct in his forecast of future CO2 emissions, then civilization may be trapped in a collapse scenario. The collapse scenario contradicts just about every mainstream perspective on climate change, including the popular notion that a zero carbon future is possible with a combination of carbon taxes and political will. We must therefore ask ourselves if humanity has sufficient agency to reverse global warming? If not, then what actions should be taken to generate the additional required agency?

The classical/neoclassical school of economics tends to assume that agency is provided by human actors—called market actors—and by government agents who have the authority to implement public policies. Conversely, the biophysical and ecological schools of economics tend to assume that agency is provided by energy dissipation, as explained by the First and Second Laws of Thermodynamics. Both assumptions appear plausible, but these assumptions create a paradox. The paradox is that the discipline of economics is torn between the social sciences and the natural sciences. It is argued here that the Paradox of Agency is the primary source of psychological bias and false dichotomies in humanity’s quest for effective climate mitigation and long-term sustainability.

No Silver Bullet

Before we tackle the Paradox of Agency and the wicked problem of climate change, it is essential to note that the Silver Gun Hypothesis is not a ‘silver bullet’ solution because the proposed economic model is not a monolithic technical solution. The new economic model is metaphorically described as a Silver Gun that everybody can use to fire his/her own bullets. I am proposing that the Silver Gun will incentivize the widest possible spectrum of technical solutions to climate mitigation. The Silver Gun Hypothesis involves a global carbon reward that is inspired by a reinterpretation of climate policies based on the changing entropy of carbon in the environment, and some other new concepts, as introduced below.

New Economic Concepts

The Silver Gun Hypothesis introduces three major new concepts: (A) climate policies should be interpreted in terms of their effect on the entropy of carbon in the environment, (B) a parallel currency system can be used to macro-economically manage the economy for sustainability, and (C) a new ethic of good inefficiency is needed to complete a risk-based management approach to climate mitigation. These concepts are not ideologically driven because they are supported by a solution to the Paradox of Agency and the laws of nature.

The major new economic concepts include:

(A) Entropy represents one of the most important insights that physics has yet provided about the natural world. Unfortunately, the concept of entropy is usually overlooked by economists and is often ignored by scientists. The inspiration for the Silver Gun Hypothesis is a re-interpretation of climate mitigation policies based on the changing entropy of carbon in the environment. The first radical new concept is that a global carbon reward is related to the simple carbon tax through the Second Law of Thermodynamics, and that the global carbon reward is needed to manage climate risk.

(B) Money is at the heart of the sustainability issue, because money is the official benchmark for comparing value in the marketplace. Noteworthy is that classical economic theories and policies do not have scope to place value on living organisms and natural processes unless these organisms and processes are involved in producing goods and services. In other words, ‘natural capital’ has no market value when it is independent of Gross Domestic Product (GDP). A fundamental solution is to introduce a parallel currency for protecting natural capital within the framework of climate risk management. In this approach, the economic value of natural capital is equated with the cost of mitigating climate change. The second radical new concept is that a parallel economy is needed to achieve long run sustainability.

(C) Implicit in every economic policy is a justification based on ethics. The dominant ethic of neoclassical economics is to improve economic efficiency. Improving efficiency is intuitive because it implies that we can obtain more goods and services from the same amount of inputs: energy, labor and natural resources. A radical new concept is to complement economic efficiency with good inefficiency. The justification for introducing good inefficiency is that economic growth is not good if civilization grows beyond the Earth’s carrying capacity, and that good inefficiency can be used to responsibly manage growth. The third radical new economic concept is that good inefficiency is needed to achieve long run sustainability.

The Five-Part Essay

The Silver Gun Hypothesis will be presented as a five-part essay on the MAHB website over a period of about 6 months, and it will coincide with two book launches in 2018. The five parts to this essay will be:

Part I – Carbon is King

Part I provides an introduction to carbon as the primary building block of living systems and a primary influencer of climate change.

Part II – The Entropy of Carbon

Part II describes the entropy of carbon, and will explain why we should incorporate both the entropy and mass of carbon into our evaluation of climate mitigation policies.

Part III – Risk and Entropy

Part III presents a conceptual link between the entropy of carbon and climate risk, and will explain why there is a need to price climate risk into the global financial system with a parallel currency.

Part IV – Money as Environmental Policy

Part IV explains why monetary systems are more than tools for solving the double-coincidence of wants, and why all monetary systems can also be described as market-based policies with environmental and social implications and impacts.

Part V – Holistic Framework for Economic Sustainability

Part V, which is the final installment of this essay, will present an integrating statement that links the previous four parts together in a holistic framework for sustainability: the Silver Gun Hypothesis. Part V will also discuss certain weaknesses of Herman Daly’s steady-state economy (Daly 2014).

I look forward to further exploring the Silver Gun Hypothesis with you in the forthcoming parts of this five-piece essay.

References

Chen, D. B., van der Beek, J., and Cloud, J. (2017). Climate mitigation policy as a system solution: addressing the risk cost of carbon. Journal of Sustainable Finance & Investment, 7 (3): 1-42.

Chen, D. B. (in press). Central Banks and Blockchains: The Case for Managing Climate Risk with a Positive Carbon Price. In: Transforming climate finance and green investment with blockchains. Elsevier. A. Marke, Ed., Chapter 15.

ISO (2009). ISO Guide 73:2009 Risk management – Vocabulary.

Daly, H. E. (2014). From Uneconomic Growth to a Steady-State Economy. Advances in Ecological Economics. Cheltenham, UK; Northampton, MA: Edward Elgar.

Garrett, T. J. (2012). No way out? The double-bind in seeking global prosperity alongside mitigated climate change (v.3). Earth System Dynamic, 3 (1): 1-17

Robinson, W. J. (2014). Global Capitalism: Crisis of Humanity and the Specter of 21st Century Fascism. The World Financial Review, print (May-June edition) and on line edition (May 28).

Rockström, J; Steffen, WL; Noone, K; Persson, Å; Chapin III, FS; Lambin, EF; Lenton, TM; Scheffer, M; et al. (2009). Planetary Boundaries: Exploring the Safe Operating Space for Humanity (PDF), Ecology and Society, 14 (2): 32

Steffen, W.; Richardson, K.; Rockström, J.; Cornell, S. E.; Fetzer, I.; Bennett, E. M.; Biggs, R.; Carpenter, S. R.; de Vries, W.; de Wit, C. A.; Folke, C.; Gerten, D.; Heinke, J.; Mace, G. M.; Persson, L. M.; Ramanathan, V.; Reyers, B.; Sorlin, S. (2015). Planetary boundaries: Guiding human development on a changing planet. Science. 347 (6223): 1259855.

UNFCCC (2015). ‘Adoption of the Paris Agreement, 21st Conference of the Parties’, Paris: United Nations. Report No. FCCC/CP/2015/L.9/Rev.1

Unruh, G. C., (2002). Escaping carbon lock-in, Energy Policy 30 (4), 2002, 317–325.

You can learn more through Global 4C’s policy website and YouTube Channel.

Acknowledgements

The work carried out by the author received no financial support from industry or government. The author would like to thank the Center for Regenerative Community Solutions, USA, EconoVision, Netherlands, and expert advisors and volunteers who support the Global 4C project.

About the Author

Dr. Delton B. Chen is an Australian engineer who holds a Ph.D. from the University of Queensland for his hydrogeological study of Heron Island, located in the Great Barrier Reef. Delton is a modeler/analyst in groundwater, hydrology, hot-rock energy and greenhouse mitigation. Delton is a co-founder of the Global 4C climate policy and is the lead developer of the Holistic Market Hypothesis (HMH), which is a new hypothesis that explains how/why climate risk can/should be priced with a Central Bank Digital Currency (CBDC). Delton is a research fellow with Project Drawdown and Data61.

The MAHB Blog is a venture of the Millennium Alliance for Humanity and the Biosphere. Questions should be directed to joan@mahbonline.org

MAHB Blog: https://mahb.stanford.edu/blog/silver-gun-hypothesis/

The views and opinions expressed through the MAHB Website are those of the contributing authors and do not necessarily reflect an official position of the MAHB. The MAHB aims to share a range of perspectives and welcomes the discussions that they prompt.